Swiss trust & fiduciary expert MARKUS DUCREY, a veteran of the Foreign Ministry and UN Anti-Organized Crime Task Force [Money Laundering], analyzes in detail the surprising rejection by Swiss voters of a proposed “harmonization” tax reform for international corporations operating there. Above, a popular graphic from the successful “NO” campaign: “The Carriage Is Overloaded”

“The carriage is overloaded” – USR III – NO! On 12th February the Swiss voted against the country’s right-wing political establishment and a new Swiss Corporate Tax Reform. The reform — known as CTR III / Corporate Tax Reform, or USR III in German, the country’s dominant language — was promoted by the European Union (EU) to abolish special tax privileges for international companies in the tiny, independent Alpine nation. BACK TO STEP ONE again. „We the people“ have decided — Swiss direct democracy lives, says one proud citizen

In order to understand the process of what was going on in Switzerland, first, some key background information:

The Swiss Federation consists of 26 cantons, ranging from densely to sparsely populated.

International companies operating in Switzerland are taxed according to special rates, based on 5 existing tax categories:

- Holding companies,

- Domicilary companies,

- Mixed companies,

- Swiss Finance branch and

- Principal Gesellschaften, a not very widely known special tax category.

This set up brought heavy criticism from the EU in 2012 and 2013, when it was seen as allowing Switzerland to offer major tax breaks to both global and EU companies wishing to establish a corporate presence there.

Former Swiss Finance Minister, Evelyn Widmer-Schlumpf (BDP) in the Swiss government press conference hall, Berne 2015. While Widmer-Schlumpf retired on October 28 that year, she was a major force behind USR III.

At that time, the EU and OECD put heavy pressure on the Swiss Government, especially the center-right Bürgerlich Democratic Party [BDP] and its then-Finance Minister Evelyn Widmer-Schlumpf,

going so far as to threaten economic sanctions if changes were not made in Swiss tax law.

Frau Widmer-Schlumpf was a former member of the largest and more nationalist Swiss Volkspartei (SVP), who created the BDP after repeated problems with Christoph Blocher – the flamboyant right-wing leader and billionaire former owner of Ems Chemie.

A renegade from SVP when she took office — against the instructions of her political boss, then SVP party leader and current Swiss Finance Minister, Ueli Maurer —

Widmer-Schlumpf was put under heavy pressure by the EU in 2013 on the fact of harmful tax competition by 5 privileged tax regimes in Switzerland.

A well-known success story for Switzerland were the Swiss Holding and „Mixed company“ preferred tax categories for international operating companies,

which made Switzerland a very competitive jurisdiction that caught the attention of the EU.

On October 2014 Mrs. Widmer-Schlumpf and the Federal Council came to agreed terms with the EU

to abolish these preferred tax regimes no later than the beginning of 2019.

They came to this agreement, however, without any consultation with the Swiss public,

which would have expected a public vote, due to the significance of the issue for the Swiss economy.

The Swiss government decided at that time, on the initiative of Mrs Widmer-Schlumpf

to give up these preferred tax regimes in order to follow a policy of appeasement towards the European Union.

The reasoning was obvious: as the then-Finance Minister Widmer-Schlumpf argued at the time,

it would be foolish for Switzerland to try to defy the wishes of its biggest export partner, lest it face the possibility of economic sanctions.

As a matter of consequence out of this political dilemma the government, the cantons and the majority of the political parties represented in the Swiss Parliament

worked out over the past five years a new law named Corporate Tax Reform III (USR III),

which finally came to a public vote on February 12, 2017 —

and, as it turned out, created the biggest political turmoil in Heidiland in many years.

Importance and impact of those tax regime changes to the Swiss economy

In Switzerland the current situation caused a significant problem,

as the abolition of these preferred tax regimes would have had a clear impact

on 24’000 companies, employing more than 150’000 people,

which are subject to these „preferred tax regimes“

and would have faced severe and partially unpredictable consequences.

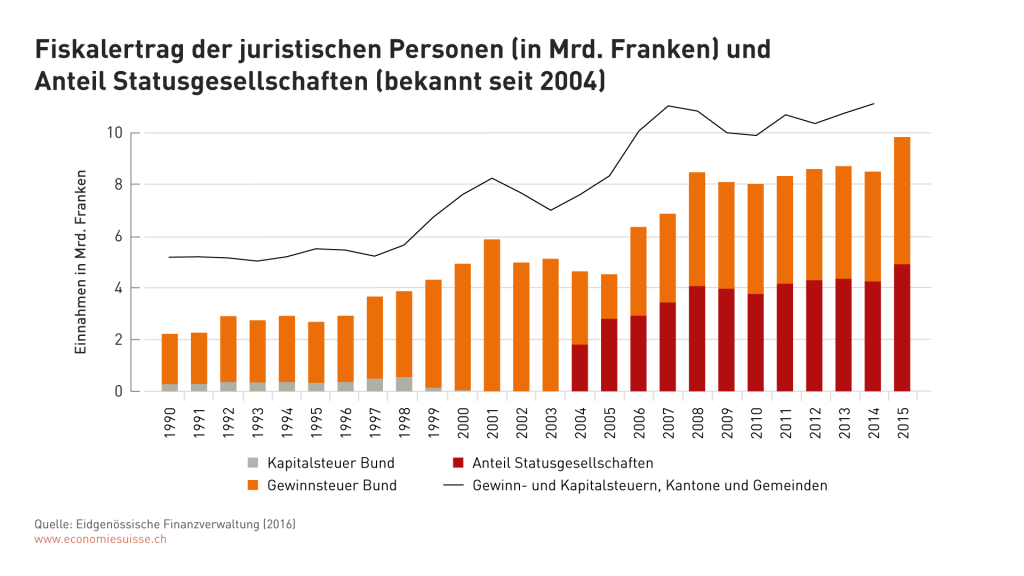

To this group of companies (see statistic below published by ECONOMIESUISSE on their website during the campaign) belong

not only all foreign multi-national groups but also many Swiss companies operating out of Swiss Headquarters.

Companies without any business operations, which purpose is only the holding of participations,

so called „Swiss Holding Companies“, whose activities in Switzerland are reduced to merely administration or finance holdings and

in reality only effect very few effective connected operating business activities and related income have the right of qualifying as „Mixed Companies“ (usually corporate income above 80% of the annual income).

Mainly the latest are very significant for the Swiss economy and the Swiss tax authorities

as they are in fact responsible for almost 50% of the whole private Research and Development (R&D) expenses, which amounts to approximately CHF 6bn.

The job impact of these companies for the tiny country in the Swiss Alps is huge,

as, for every direct employee, an estimated minimum 1.6 other jobs outside these companies are effectively connected,

according to the website of Swiss industry lobbyist group ECONOMIESUISSE, www.economiesuisse.ch.

A lot of SMEs (Small and Medium-Sized Enterprises), such as Swiss Financial Services industry but also the Swiss Consulting industry

do profit to a wide extent from the demand for such „privileged tax companies“.

Switzerland has a peculiar tax system and taxes its corporations on three levels, namely

(a) Federal level,

(b) Cantonal level and

(c) community level,

all of which was formed in the years since the creation of the modern Swiss Federal States in 1848,

and developed a sophisticated and balanced tax system in the years afterwards for their citizens and corporations.

The Federal Government did not grant such „privileged companies“ a special tax reduction or, indeed, any privileges at all.

This was uniquely done on the Cantonal level (b) above but profits enormously from these Cantonal „special tax regimes“.

Americans, for example, might be familiar with the Canton of Zug or Schwyz or Canton de Vaud

which grant significant tax cuts for corporations but also private individuals when settling down there.

However, a very big portion of exactly such tax income –

by way of a tricky system of tax income balance compensation between the cantons and the federal government —

flows into the pockets of the Swiss Government –

and the Ministry of Finance for their overall governmental spending on the federal level.

Although these 24’000 companies reflect only 7% of all Swiss companies,

these companies with „special or preferred tax status“ contribute almost up to 50% of the corporate tax income of the Federal Government,

as can be seen on the graphic below.

If we add (a) the Federal Tax and (b) the Cantonal Tax income the figures amount to roughly CHF 5,4bn to the overall corporate tax income,

we can see the importance of this law not only for the Federal Government but also for the Swiss economy, as its in fact a huge tax income contributor.

Furthermore, by way of additional generated tax income (capital tax, real estate – and real estate sales taxes and V.A.T.),

significant social insurance expenses and the related income tax of the mentioned 150’000 employees

those companies deliver significant contributions in CHF into the Swiss Federation.

Significant development of tax income from corporate tax income

The above overview published by ECONOMIESUISSE (www.economiesuisse.ch) the Swiss lobbyist group, financed by Swiss industry and its leaders, titled „Finance revenue of all legal persons (in CHF bn; orange colored) and the percentage of preferred tax status companies.“ These statistics have been recorded only since 2004. The part of the column marked in red shows the percentage of Swiss income coming from the 24,000 companies operating under tax regimes the EU wanted Switzerland to abolish. The NO vote maintains the status quo — for the time being. The estimate was that roughly 150’000 jobs are DIRECTLY linked to the income of such companies with preferred tax status.

Statistics show that the nominal GPI of Switzerland increased since 1990 by 80 percent

and also show that standard tax income from corporations on the (b) level – i.e. on the Cantonal tax income side – doubled

and on the (a) level – the Federal Government – even quadrupled in the past 27 years.

Responsible for this significant increase for the Swiss were mainly international companies who were attracted – not only by the preferred tax regimes –

but also by Switzerland as a whole with many other advantages,

but the preferable taxes particularly in the context of increased global tax competitions,

as we see it now in the United States and the United Kingdom,

remain of utmost importance to attract jobs and the global-multi-national corporations.

Given this, one might ask „Why to hell would the Swiss give up this unique tax advantages“?

Well, we were forced by the European Union, but in fact …

the response is actually is not such easy to explain and

lies in the roots of direct democracy and probably the stubbornness of the Swiss people

as well as at the impact of globalization and the speical relationship of the Swiss to the EU.

A threatening and failed European Union which in recent years more and more – according to many Swiss ordinary citizens –

tries and did try to imply their standards, their laws and their political saying as such and as a matter of logical consequence

the true purpose of the EU to create a „United States of Europe“ would automatically lead to destroy the neutral and independent Swiss National State —

at least in the minds of many right-wing Swiss citizens.

Well, whether we can actually refrain from the process and consequences of globalization and the influence of a supra-national state vehicle like the EU remains to be seen.

However, it is in fact true that the EU in recent years and due to the clear political failure of their political elite in Europe — eg,

the financial crisis 2008, Greece crisis 2010 and 2013, the refugee crises 2015 and the EURO-disaster following the BREXIT in the United Kingdom,

as well as initiatives in Iceland, which already had to leave the EU, Scotland and Catalonia to leave the EU and

the clear and present danger of Italy and Spain to balance out their economies just to name a few —

did create a clear and overwhelming mistrust towards the EU, which was unprecedented so far in my country Switzerland.

As a liberal thinking person I believe Switzerland should follow an open economic policy with all countries and not choose a protectionist path.

However, the price for it did seem to high for the Swiss popular voters – the giving up of their „Swiss independence“

which grew over centuries and created a unique direct democracy system in our country.

I personally believe that the European Union would work if we can maintain a lot of our Swiss political system architecture,

but the lack of direct democracy and the development of the political arrogance and distance to unify the Europeans with their „European Union“,

failed ultimately by the creation of the EURO which seems to rip Europa apart.

However, many observers do see it as a unique chance to reform the EU, which is needed more than ever.

Only … the Swiss do not believe in this anymore, given the outcome of recent years and the negative attitude of the EU towards Switzerland in tax matters.

According to surveys made last year during the Swiss Public Elections not even 17% of the Swiss would have would voted to join such an EU,

which made it almost impossible for the Socialist Party (SP) and the Green Party (Die Grünnen) to use the EU arguments in their political campaigns anymore,

which they have done since 1991, when the Swiss voters clearly voted against joining the EU.

This seems to have been a wise decision, given the critical estate of the financial stability and the security threats in Europe from today’s view point

as a country in the heart of Europe with the biggest per capita foreign population compared to all other countries in Europe.

(From right to left): The Swiss Finance Minister, Counsil Federal Ueli Maurer (Swiss Volks Party – SVP) to the very right who was responsible for the campaign with all the cantons in his back, here represented by M. Charles Juillard, president of the Swiss Conference of Finance Directors of the Cantons, CDF, and Frau Eva Herzog (SP), a left-wing socialist politician from Basel-City, who fought for the patent-box solution for the big pharma multinational corporations in her home town Basel, Northwest-Switzerland.

There is something ironic and even paradoxical in the fact that voters of the right-wing political party of Mr. Ueli Maurer the Swiss Volkspartei (SVP) did sunk their political elite which unisono were proclaiming to accept UTRIII.

An analysis of the voting statistics of last week show that this is true.

For example the important Canton of Zurich whose importance is huge for the SVP in the country side (County Andelfingen Zurich) a farmer dominated region of the Canton of Zurich and a beautiful countryside,

which is also one of the fortresses of the Swiss Volkspartei (SVP) – with an average of 40% voters for their party – 60% of the citizens voted against UTRIII.

Furthermore and even more irritating for the popular and biggest right-wing party in Switzerland is the fact that more voters said NO to the USR III

than voted NO to an „easier citizenship for third generation foreigners“, which was also one of the public votes of this particular weekend,

as SVP has a clear policy to harden the integration of foreigners in Switzerland with all means whatsoever in the past,

just to mention the initiative against minarets in Switzerland, which was in clear conflict with religious freedom as stipulated in our Swiss Constitution.

Even clearer were the voting results in the county of Dielsdorf, a subburb of Zurich, where the SVP scores regularly extremely high votes by attracting the citizens there with an average of 46%.

The president of the Swiss Socialist Party (SP) Christian Levrat (left) and his team, who fought a successful campaign against the proposed Corporate Tax Reform III (CTR III) in Switzerland – a fight „for the people“ on the streets, with a message that reached deep into the voters of the right-wing parties –– so different from the US !!! The anti-USR III campaign was organized by the left-wing parties SP (Socialist Party) and the GREEN PARTY (DIE GRUENEN). They found the proposed law disadvantageous for the Swiss middle-class — and extremely attractive for huge multi-nationals and already rich company owners.

In this county the voters were with an extremely high 62% against USRIII.

The left-wing parties Socialists Party – SP — lies with 13% much below, and the Green Party – DIE GRUENEN, with only 4% below the average voter who clearly are SVP-minded.

Very similar – and equally disastrous results – could be recited out of my analysis this week for other Swiss regions and counties,

whether in the Canton of Berne or in Basel-Country, whether in the Eastern part of Switzerland (Canton Saint Gall, Thurgau, Grison) or in Central Switzerland – Canton of Lucerne:

the usual voters of SVP did what they wanted against all odds and against all predictions of their political elite leaders.

I used ‚ironically’ as it is a political fact in Switzerland that so far no other party is able to lead a political campaign as efficiently and with routine and right-wing populist panache than the SVP

which brought the party lots of criticism abroad but particularly in our country.

That its own „political elite“ would be subject to such a significant failure was clearly not foreseen.

And „paradox“ it seems to me because it hits the nail to the unpredictable charme of our Swiss Direct Democracy.

Even the „Anti-Elite-Party“ of Switzerland will be made to play „second fiddle“ by the Swiss people

who not only elected but now even ‚corrected’ them in our carefully balanced out political system,

which does not exist elsewhere in that form and historically developed over centuries.

This should not be underestimated.

No wonder exist powers who want to abolish direct democratic rights as it is cumbersome for some political hotshots

and the ambitious politician who seeks power more than the service for his constituents.

Noam Chomsky once analysed it in a simple and sharp political equation and as it seems to me as clear as a Swiss mountain lake as follows:

„Concentration of wealth yields concentration of political power.

And concentration of political power gives rise to legislation that increases and accelerates the cycle.“

A few other reflections do arise when analysing it in much more depth.

Despite the fact that with regard to the CTRIII campaign, which was poorly managed, wrongly and not sufficiently explained to the wider public, which would have let it fail in the first place,

there must be a deeper cause behind it due to the explained fact that almost the whole economic elite and political class was for it.

Why is that, as I asked above?

Well, for once the media cannot be blamed, as most of the Swiss head journalist from left to right did what they should do.

They covered actually all aspects of it with its advantages and disadvantages like it should be expected from them.

This was – in my personal opinion – quite good, as it covered the needed pluralism of the argument and thus assisting the voter to make up its mind.

No, much more decisive for this vote seem to be TWO ROOT CAUSES, which have generally not been addressed very thoroughly so far.

Economic historian Tobias Strauman did mention this in a major Swiss Newspaper (BLICK) reaching a huge part of voters,

and it is his idea and approach for an easy explanation: „Very rarely the government succeeded to win a Swiss Tax Reform.“

In fact a lot of commentators did not think or cover this — despite the fact it is actually true.

If there is something like a „federalistic DNA“ of Switzerland then it can be found in the fact that

the Swiss voter does not trust the Federal government in Berne where finances are concerned.

Or, more accurately: where taxes are concerned.

This is very much born in the circumstances how our tax system is set-up on the levels (a) to (c) mentioned earlier.

For example a Swiss V.A.T. was only introduced after cumbersome decades of failures and opposition.

Again and again the Swiss people and the Cantons rejected this tax project.

Also the „Direct Federal Tax“ – i.e. the tax where the overlaying Federal Government obtains the tax income — would never have been realized in Switzerland, were it not for two World Wars,

which allowed the Federal Council in Berne to implement this tax –

which – after the wars – remained a provisional decree – but were nevertheless never rescinded.

Put bluntly, what is always the case when the State implements any tax —

the Federal State in its own character and purpose never gives up that which was granted to him by a once-imprudent citizenry.

The subversive element of „Kantönli-Geist“ – „The Spirit of Cantons“

Since the formation of modern Switzerland and the Swiss Federation in 1848,

the right to increase or decrease taxes historically belongs to the preliminary and foremost rights of the Swiss Cantons — and not the Federal Government.

Consequently, if there is something like „location marketing“ in Switzerland, this will primarily be done on a Cantonal level.

Whether it reflects important decisions on construction projects such as infrastructure or taxes:

the Swiss voter did prefer and continues to prefer to decide this on a Cantonal or even County level,

where he knows the government or the individuals representing him on this level.

It’s where he or she trusts or mistrusts —

but more importantly where he/she can better evaluate and decide the topic in question.

That the USRIII left willingly open what the individual Swiss Cantons do with it after the tax law would have been accepted,

was a misconstruction of the campaign from the beginning, as the Federation does not have the trust in finance questions,

and is supposed „to spend the money the Swiss earned“ rather than to look for the benefit of its people.

In all these cases usually the Swiss voters refrain from accepting such tax laws as surely as the „Amen“ in Sunday church.

Switzerland does have a unique political system, which in reality reflects its simultaneously convervative and liberal approach.

An important element is not only the political system of direct democracy –

in fact a „democracy of institutionalised mistrust against its political elite“ –

but also the unconquerable tendency towards decentralisation,

which shaped and heavily influenced our little country since the early 13th Century.

Perhaps nothing protected our freedom more than the so called and often mocked „Kantönligeist“

which can be translated as „the influential spirit of the Cantons“ –

where within a short geographical distance you can find an enormous diversity of opinions, minds, and social influences –

which – in reality – only the political elites mock about in most cases –

by underlining it would be „old fashioned“ an „old and obsolete traditional in our modern world with no or low influence“.

As a matter of fact these are exactly those politicians and economic leaders who see themselves in the gravity field of political power in Berne –

a political syndrome or disease which during the continuing globalization can also be observed in other neighbouring countries such as the EU,

but also Germany and France or Austria and Italy, Spain or very popular Turkey and Russia now –

as nothing secures and empowers the power of the politicians more than centralization of the government and accumulation of power.

This leads to a conflict of interest for the people and a destroying imbalance of power for democracy itself.

This is also why there is no such thing as a ‚Federalistic Dictatorship’ – it never existed and it never will.

It’s actually where the subversive powers of our Swiss Cantons are reflected like in a clear glass —

and anarchy rises sometimes in the gleam of the sides and blaze in the light like flames of our Swiss Federation by way of „Kantönligeist“.

It’s almost like a spirit of revolt — and sometimes revolution — of the people,

as whoever in the past and the present — including joining the EU or military alliances like NATO — wanted to further centralize Switzerland –

and in the effort to do so actually tried this the democratic way – it failed heavily.

This is why the government and their government bodies and employees tried to do it in „covert and politically clandestine ways“,

what makes it even worse, because the Swiss citizen does not very often notice it.

This is why the Swiss opinion generally is the following:

„If our Swiss freedom will be grilled, it will be in Berne on the Federal level, in the offices of our centralized bureaucrats and their departments“

This is also the reason why so many politicians —

or lobbyist or government employees who ear-whisper them or even control them —

would love to work together with the EU, if not joining Bruxelles:

because in Bruxelles – in the EU – is even more Centralism

and a single Swiss citizen, be it in the Cantons of Basel-Country or in the County of Dielsdorf near Zurich, also has no or much less influence.

In this regard it was also not an ‚unfortunate coincidence’ where this Company Tax Reform actually had its beginnings,

with Frau Widmer-Schlumpf and a EU-oriented Federal Council.

As outlined above and as a matter of political fact, it was not the elite politicians in Berne who dared to abolish the decade-long established „Swiss Holding Tax“

but the EU, or pressure by the EU upon a weak Federal Council.

At least that’s how a lot of Swiss citizens did see it in reality —

but the politicians would never enter into this argument as they see themselves anyway as superior to the people — did cause this reform if we analyse this correctly.

The EU or better its officials in Bruxelles did request such a Corporate Tax Reform,

and because they know neither nor appreciate our independent Swiss political system,

they imagined it would suffice to succeed in Berne with our central government to realize their requests.

That Berne was not able to keep the promise made by the former Finance Minister Evelyn Widmer-Schlumpf back in October 2014,

and that the Swiss have a litte bit a more complex and better leveled out political system of checks and balances,

was not at all of interest for these bureaucrats in Paris (OECD) and Bruxelles (EU).

They did reckon– as many times with their failed calculations and assumptions in political EUROLAND – without one’s host.

CONCLUSION

The interdependence of wealth – expressed by the Swiss economy and the parties of the Swiss economy and their leaders, which according to political analysts are

- the Federal Democratic Party (FDP) in Switzerland,

- the SVP (Swiss Volkspartei) and

- wide elements of the moderate middle parties (CVP – Christian Volkspartei) and BDP (Bürgerliche Demokratische Partei) and

- some elements of the „Green Liberals“ (GLP – Grünliberale Partei)

were all following the political credo that

if the corporations do perform well, automatically the Swiss employer would too.

Globalization seemed to validate this view,

as every year since 2010, Switzerland eliminates more than 60,000 unemployed persons from their statistics — they simply vanish.

Globalization, and the reactions to it, to hire more and more foreigners, meaning that more and more Swiss face unemployment

already helped the SVP win the „Mass-Immigration Vote“ — a vote to limit immigration against the policy of the EU.

Again, another indicator to the „classe politique“ to become more prudent in future political initiatives and to better feel the pulse of the common man.

This was clearly not done by ignoring the warnings of the politically and socially strong left-wing parties SP and DIE GRUENEN

and so they took the referendum against Corporate Tax Reform III,

as they saw a lot of support in their voting constituents, the still very dominant Swiss middle-class.

Such a process is – however strange , slow and cumbersome it seems for the observing outsider – very „Swiss“ —

as ticking along with the political life and the political questions in our country is not always easy but it’s a true reflection of „direct democracy“ —

and as such can have a positive reflection on other states, where a big bulk of their citizens would love to have similar political rights.

On the other hand, you can easy imagine that this is cumbersome and not very funny

if you are a ‚political leader’ who needs to solve problems quickly in our ever-more complex world

and who needs to negotiate with super-national political vehicles like the EU.

It certainly does not make political life as a politician in Switzerland easy at all.

But as the great US President Franklin D. Roosevelt once eloquently put it:

„Let us never forget that government is ourselves and not an alien power over us.

The ultimate rulers of our democracy are not a President and senators and congressmen and government officials,

but the voters of this country.“

I would assume that the public vote of February 12. 2017 did reflect the spirit of FDR in a very wise and accurate way,

and it showed the elected „classe politique“, as they are called in Europe, (i.e. the „political class“)

the boundaries of their power and the spirit of democracy in itself.

Namely, that the people finally decide in our system.

In my opinion, this vote also shows that sometimes people with strong ideology, whether left-wing or right-win,

refuse to do something simply because they believe it is wrong, even if doing it would actually benefit them.

Here in Switzerland we love and live our political rights, discuss them in bars and restaurants, grew up with it in our families —

and the relatively high voting percentage reflects this every year.

It also clearly shows – and this is the „true paradox“ — that for some people, their political voting right is not just about money or taxes and political power.

It’s about the feeling to be part of such a system and to be heard.

Finally it’s simple and very well balances out political risk management, which goes back to the roots of democracy as Plato also analysed crystal clear:

„One of the penalties for refusing to participate in politics is that you end up being governed by your inferiors.“

In the light of this, such public voting rights — which are exemplary and a distinguishing political element for our direct Swiss democracy compared to other nations,

and which in fact let’s us vote for important and sometimes less important public endeavours and new laws —

are the true embedded and real political character of Swiss democracy,

where the power of the few – for example contrary to an oligarchy ( oligoi – in Greek: the power and government of only the few) can ultimately be limited similar to a political „emergency brake“

and correct our political leaders once in a while to start over again

the time-taking process of finding a well-balanced solution workable for all parties of our political pluralism.

Instinctively, the stubborn and rebellious Swiss sunk the political and economic intention

with a decisiveness that the elites in Berne, Zurich, but also Bruxelles and Paris should reflect upon.

The latter of course do not care at all about these facts, which is why they do not even understand to interpret last years Brexit correctly, as they feel they don’t need to.

They already a long time ago subdued their people to tribute-paying subjects.

And to end once more with the great philosopher Plato: „There are three classes of men; lovers of wisdom, lovers of honor, and lovers of gain.“

Probably wisdom won this time in Switzerland.

The Swiss politicians — and economic lobbying groups and CEO’s and managers including journalists —

on the other hand cannot avoid facing this important democratic discussion and to take the verdict of the Swiss people seriously,

because they are still also part of one of the most curious and anti-elitist democracies in the world,

which once in a while also teaches the necessary virtues of political humility.

—————————

About the author:

Markus Ducrey, TEP SACTM, is a trained Swiss Trustee and Fiduciary expert and alunmi of the Swiss Advanced Certificate in Trust Management of STEP Switzerland and the University of Geneva (www.sactm.ch) who worked for the Swiss Government in the Ministry of Foreign Affairs in the Swiss Expert Pool for Civilian Peacebuilding where he was involved in the fight against Organized Crime in the mission of the United Nations in Guatemala (www.cicig.org) in 2013 + 2014. Since 2016 Mr. Ducrey is working partially on a consulting basis for HUBER PARTNERS and is furthermore an independent consultant today working out of Zurich accepting various mandates in the areas of finance and trust as well as political and economic analysis. Further details and articles from and about Markus Ducrey can be found on his LinkedIN profile.